The Young, Long-Term Investor Should Love Crypto

I write about the future of Business, Psychology, and the Creator Economy. My goal is to educate, motivate, and create educational content for my readers. If this interests you, Subscribe to my “Predicting The Future” newsletter and get new articles directly to your inbox!

Sure, the crypto market is extremely volatile; however, with widespread adoption & institutional investing, expect to see above-average returns if you invest for the long term.

*None of this is investment advice. Please do your own research and figure out your own risk tolerance.

Most Important Insight: We’re still early.

Sure, I understand Bitcoin is the best-performing asset of the last decade. Yet, When looking long-term, I believe Bitcoin and the entire crypto industry will continue to see returns above all other asset classes on average in the next 10-20 years. Here’s why: ‘21 is just the tip of the iceberg for widespread adoption, institutional investing, and a better understanding of the industry in the mind of the retail investor. For perspective, the total stock market average is 8% growth year-over-year, and I think crypto can significantly beat that if you’re risk-averse and can handle extreme volatility in the short term. Don’t actively trade crypto, this is how you lose big! The trick: don’t sell unless absolutely necessary; instead, handle the bear markets like a champ and continue to invest and dollar-cost-average (DCA) during the big crashes as well.

This is if you invested on January 2nd, 2009 - Dec 9, 2019. In 2021, $100 invested in BTC on January 2nd, 2009 would now be worth over 40 million!

Full transparency: I’m relatively new to crypto. I only started my self-education journey a few years ago. Yet, in my short time frame, a good information diet paired with a passion for trying to understand the nuances and complexities of this industry has provided a good base to continue learning and evolving my understanding. When I don’t know something I pursue the best knowledge and resources I can find in the form of articles, newsletters, videos, and more from people who are experts in their field. My personal favorite resource: Anthony Pompliano and his Pomp Letter, hands down.

With that being said, I made the decision to invest 6-8% of my overall portfolio into crypto (85% $BTC & $ETH, 15% Other) w/ dollar-cost averaging and a 10-20 year long-term time horizon guiding every decision. I also plan to invest heavily in the crashes that will inevitably come sometime in the next year or two. In my eyes, this will be a buying opportunity that will set me up for financial success 10-20 years down the road. I only wish I had the courage to invest during the March 2020 crash before the crypto explosion. Let’s dive into why I’m so excited for the future of this industry:

Institutional Investing

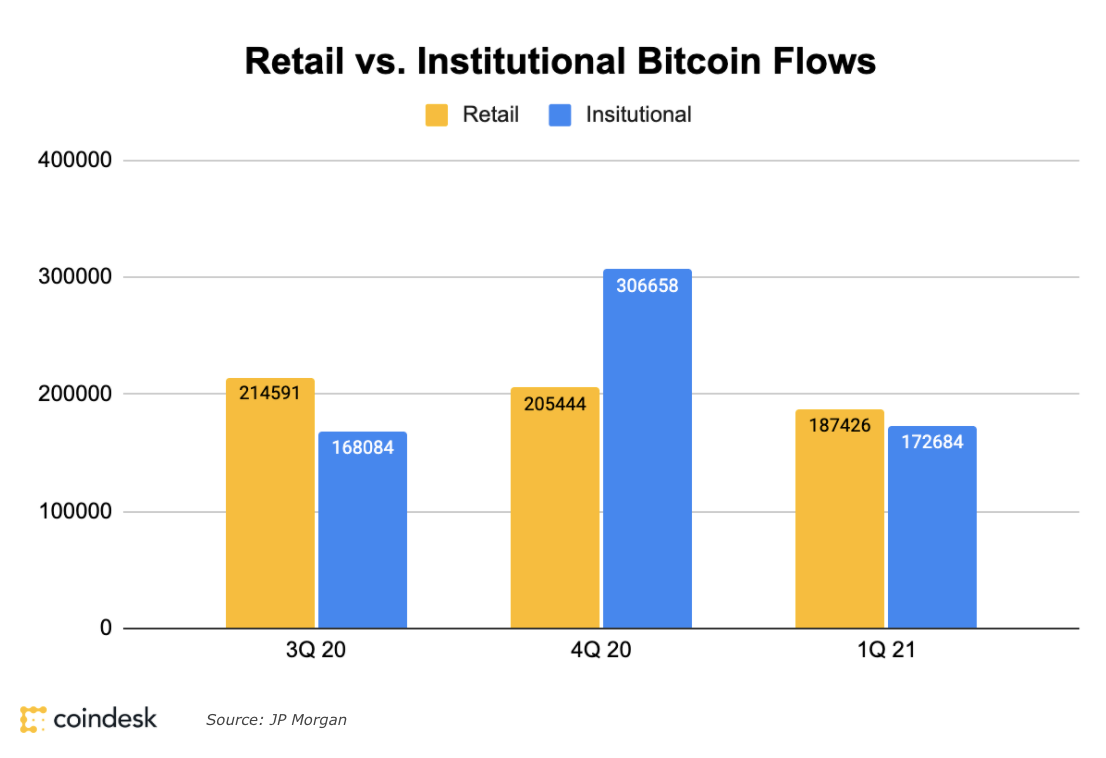

After years of sitting on the sidelines, large institutional investors are investing in crypto heavily. You see big names like Tesla, MicroStrategy, Square, Grayscale Bitcoin Trust, and many others putting Bitcoin and other cryptos like $ETH on the balance sheet as a way to diversify their holdings. Likewise, we’re seeing ETFs and Mutual Funds fighting to get approval to directly trade cryptos as well. In addition, we’re seeing big banks offering cryptos as an asset class to their investors for the first time ever. It’s just a fact that we’re going to see more and more of this, no doubt. Key takeaway: The bulk of volume has shifted in recent years toward institutional customers, mirroring the broader industry shift as more big investors nose into crypto markets.

Widespread Adoption

164 major companies accept Bitcoin as of April 2021 and many more are actively working towards this goal. In February, Elon Musk announced that Tesla would accept bitcoin as a form of payment for all models of its cars in the US. PayPal and Square have recently been positioning themselves as leaders in securing transactions of cryptocurrencies – with the latter being particularly vocal about its involvement. Likewise, JP Morgan and other big banks will now be offering exposure to Bitcoin to their wealthy customers. They can’t look away anymore. Soon, governments around the world will begin buying crypto to diversify their holdings. As more and more of the world understands and accepts cryptos, the more money they will be worth. Oh, not to mention that cryptos and decentralization of the finance world is the future.

Retail Surge

The recent Coinbase IPO helped spread the word far and wide about cryptos in the United States. In fact, Coinbase saw a 117% quarter-over-quarter increase in monthly transacting users, which is insane! Total trading volume in Q1 2021 already eclipsed the entire 2020 year. They won’t be alone in their success. Worldwide, exchanges are seeing an explosion in user growth. This trend is likely to continue into the future.

Conclusion

Don’t get me wrong, there are huge threats and major question marks that will need to be answered in this complex industry throughout the years. This asset class is incredibly volatile. But, long-term, I see big potential in an upward trend and I don’t want to sit on the sidelines. I will continue to learn, invest, and think critically about the future of this industry. I hope you consider doing the same.

As always, thanks for reading :)

Hayden Schuster