2 Ways Compound Interest Can Improve Your Life

I write about the future of Business, Psychology, and the Creator Economy. My goal is to educate, motivate, and create educational content for my readers. If this interests you, Subscribe to my “Future of Work” newsletter and get new articles directly to your inbox!

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.” - Albert Einstein

Before We Dive In, What Exactly Is Compound Interest?

Before we begin, many of us were never taught the magic of compound interest in school. In fact, according to NBC, almost 70% of Americans don’t understand it at all. That’s a complete failure of our education system, quite frankly. Put in the simplest of terms, compound interest makes a sum of money grow at a faster rate than simple interest. How? In addition to earning returns on the money you invest, you also earn returns on those returns at the end of every compounding period, which could be daily, monthly, quarterly, or annually. I know the mathematical equation may be boring, but applying this equation to your own goals in other areas of your life in addition to your finances can be life-changing advice! This article is about how you can get compound interest to work for you, not against you.

Without further ado, let’s get to the two ways compounding interest can help you reach your goals:

#1: Use Compound Interest To Make Your Money Work For You

I know, I know, this one’s boring. Nobody wants to get rich slowly. That’s not exciting. However, it’s crucially important to understand the intricacies of compound interest early on in your financial journey. Everyone should take their financial literacy seriously and put in the work to make your money work for you. The key? Begin today. The sooner you start, the more you’ll thank your future self. If I took my own advice in 2006, rather than in 2019, I’d be patting myself on the back and celebrating with an additional 15 years of compounding interest to my advantage. To prove my point, If I invested $50 every week into a total stock market index fund from when I was 16+ years old, I would have already accumulated 36K (assuming 8% interest, which is the historical average) for my retirement fund. That alone would net me a FREE $12K by the time I would turn 26. If I continued to add $50 every week for the rest of my life, I’d become a multimillionaire ($2.4 million+, assuming 8% interest) by the time I turn 65, which doesn’t even include any other investment income whatsoever. CRAZY. There’s no time to lose! Every dollar is a big deal. TIME IS MONEY!! Let me give you three more practical examples of the power of compound interest to prove my point…

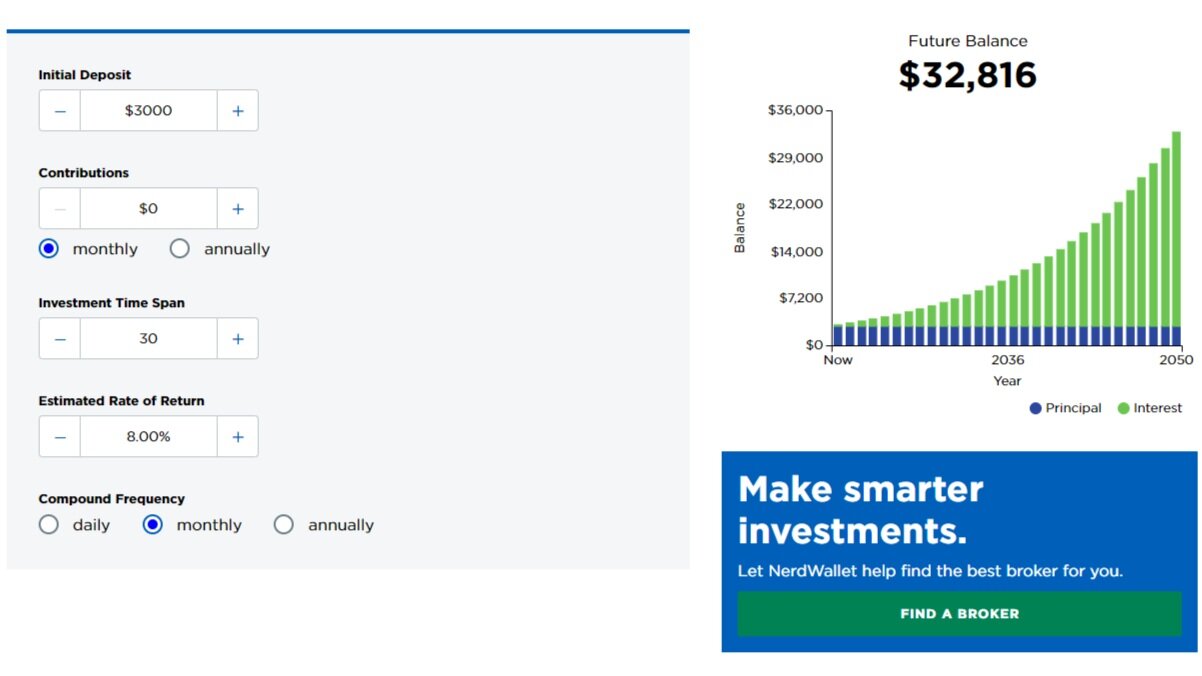

Example #1:

You decide to put $3K in a total stock market index fund (like VTSMX) and you don’t do anything else to that investment for 30 years. That $3K you initially invested, assuming the average 8% interest per year, would be $32K+ by 2051. That’s 29K in your pocket thanks to your patience, long-term thinking, and compounding interest magic. THAT DOESN’T INCLUDE ANY OTHER CONTRIBUTIONS AT ALL!

*I recommend using a Traditional IRA or Roth IRA to maximize your earnings potential. If you have questions about this, here’s a great article explaining the difference between the two accounts from Investopedia

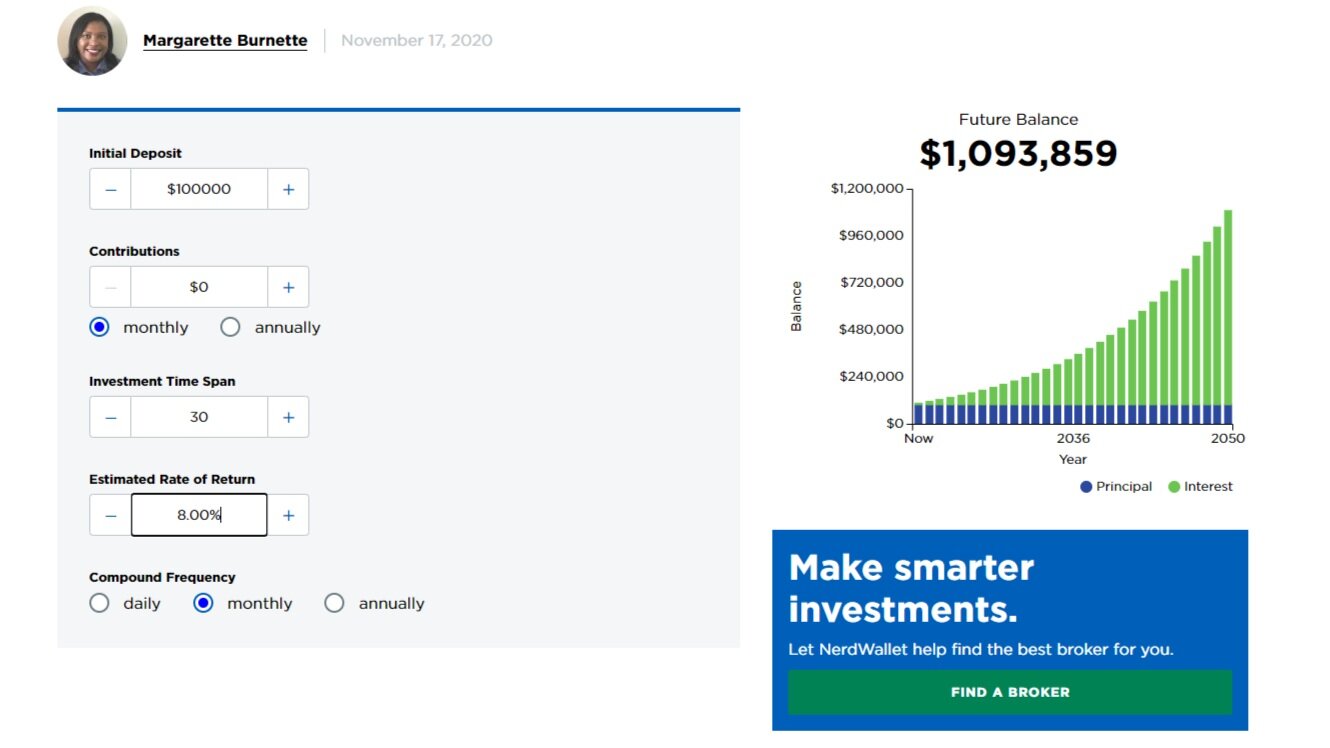

Example #2:

Say you find a way to invest $100K in a Roth IRA by the time you’re 30 years old. If you put that money in a low fee Total Stock Market Index Fund (VTSMX for example) and you don’t add another dime, you’ll likely become a millionaire by the time you reach 60. That’s $900K, assuming 8% interest. you made by doing absolutely nothing. Easy money! Just imagine if you continued to grow your investment portfolio by contributing more money monthly. With time on your side, you can make every dollar you invest start working for you. That’s powerful.

Example #3:

You have $100 saved for retirement but would like to get serious about investing for your future at 26 years old. You invest $500 every month for 34 years. By the time you hit 60, you’ll become a millionaire.

Try out different calculations for yourself! Here’s a link to my personal favorite compound interest calculator from Nerd Wallet.

*All of the above is not investment advice. Please do your own research and come up with a plan that works for your situation

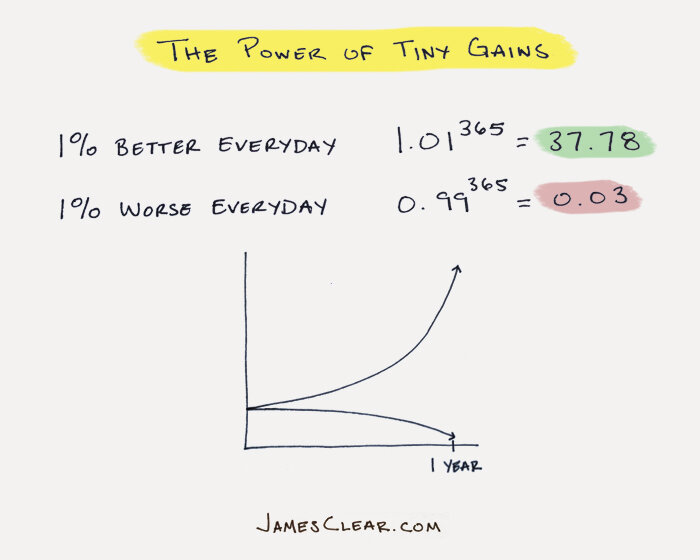

#2: Use Compound Interest to Form Daily Habits; Get 1% Better Every Day

In my eyes, compound interest is much more than a finance term. I recently wrote an article about my favorite book of 2020, which was about how you can use psychology and the idea of compound interest to change your daily habits and get 1% better every day. The following quote James wrote greatly shook my understanding of how I think about the value of compound interest in my own life:

“Habits are the compound interest of self-improvement. The same way that money multiplies through compound interest, the effects of your habits multiply as you repeat them. They seem to make little difference on any given day and yet the impact they deliver over the months and years can be enormous. It is only when looking back two, five, or perhaps ten years later that the value of good habits and the cost of bad ones becomes strikingly apparent.” - James Clear

This simple idea of visualizing my habits compounding daily rather than massive, intimidating goals that seem out of reach has changed my life for the better. Habits are easily attainable and easier to form, yet compound when you pair them with time. When done correctly, you will reach those big goals quicker than expected.

Example #1:

You want to lose 50 pounds by the New Year. This sounds hard, but remember the value of compound interest. Start simple! form a daily habit, and do one push-up per day. Then, try one push-up per day and one sit-up per day. Continue to improve 1% each day. After one year, you’ll be amazed at your progress!

Example #2:

You want to read every single day this year. Great goal! However, when pursuing that goal, it may seem too hard or impossible. Instead, promise yourself you’ll read at least a minimum of one page per day. I guarantee you that, if you do this, you’ll begin to read more and more and reach your yearly goal.

Conclusion:

All in all, what I hope you take away from this post, is that Compound Interest isn’t just a finance term; rather, when you understand the concept as a whole, it can transform your life for the better. I know it has, and continues to, help me navigate this crazy world. I hope you found value in this. Cheers!

Hayden Schuster